All About Pay Stub

Jan 05, 2023 By Susan Kelly

While federal law does not mandate that companies give employees a pay stub, numerous individual states have passed legislation mandating the distribution of a written pay statement. The Fair Labor Standards Act mandates that employers keep records of their employees' hours worked regardless of whether or not they are located in a state that mandates pay stubs.

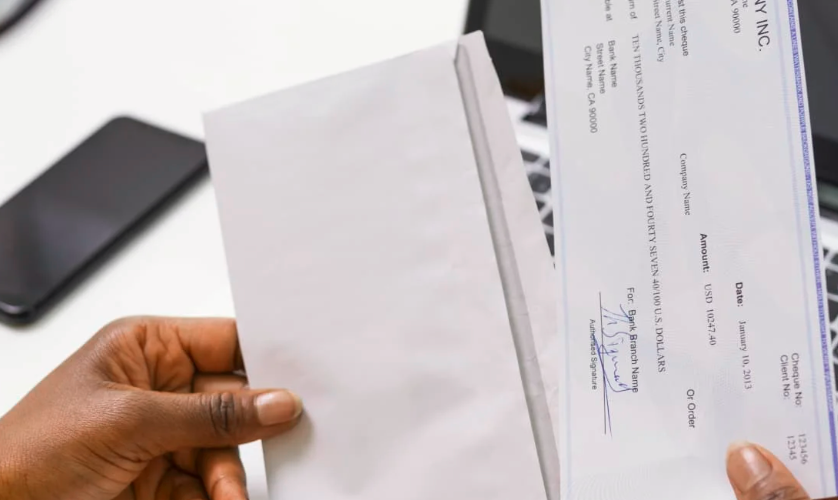

Paycheck stubs are often perforated off of the main paycheck sheet. Employees have their paychecks deposited directly into their bank accounts through direct deposit, and they can view their earnings statements online.

What information must be included on a pay stub and what state regulations and requirements you and your human resources team need to be aware of will be discussed below.

I need to include a pay stub, so why am I being asked to?

You can use a pay stub to prove to the IRS that you paid your employees what you said you did, and it can also help you straighten up any pay-related issues.

Your worker will appreciate having a record of their earnings, a better grasp of their tax, contribution, and deduction obligations, and the ability to verify that they were paid correctly. It can also be used as evidence of their employment or income, which is necessary when applying for a mortgage, credit, or even a place to live.

Even if it's not mandated by law in your state, making it simple for employees to view and download their pay stubs may be in your best interest.

Salary Structure

Gross pay is the amount of money someone receives before any deductions, taxes, or other costs are subtracted. Income taxes paid at the federal, state, and local levels and the employee's portion of Medicare and Social Security contributions are examples of withheld taxes.

Employer-sponsored pension and retirement plan contributions Net pay, the amount of money an employee keeps after deducting mandatory and voluntary deductions like those for health insurance and retirement payments, is known as take-home pay. As an employee, you should pay close attention to the following parts.

Indirect Costs of Living

The sum remains after all mandatory deductions have been made from employee salaries. The "Gross Earnings" section indicates the hourly wage and the total number of worked hours for hourly workers. It is assumed that a salaried worker will work a standard week of 40 hours.

If the worker is qualified for overtime pay, the pay stub should detail the overtime hours and the pay rate for those hours. Bonuses received by a worker would also be included in the total amount earned by the worker. In addition, it's important to note that some states have additional requirements, such as listing sick leave earned.

Deductions

Any sum subtracted from an employee's gross pay to pay for things like taxes or contributions is considered a deduction. You ensure your employees are aware of the deductions made from their paychecks regularly and be sure to provide the following information on each pay stub.

Paycheck stubs typically include tax withholdings as a deduction. Paychecks will have federal and state income taxes withheld in addition to FICA (Medicare and Social Security) tax deductions.

Contributions are another type of payroll deduction often tied to the benefits packages offered to workers. Insurance premiums and 401(k) or other retirement savings plan contributions are examples of these types of deductions. Payments offered to employees, such as employer matching contributions to a 401(k) plan, are often included in the employee's gross pay.

Earnest's declaration of gusto

If an employee lives in an opt-out state, their employer must acquire their permission before switching up how they receive pay stubs, and if they don't approve, they must continue using the old system.

If an employee in an opt-in state wants to receive a pay stub electronically, the employer must provide that option. Determine the type of state you are in and confirm compliance with any applicable requirements by visiting the Department of Labor website in your state.

How long should I keep pay stubs if an employee leaves?

For a minimum of four years, you should maintain all payroll records including employee pay stubs.

You'll need a system to compute and maintain all of your employees' payroll information, regardless of whether your workforce is mostly comprised of salaried or hourly employees. Consider using a payroll service or payroll software that stores electronic copies of these papers on your behalf to save time and effort in meeting your company's record-keeping obligations.